What Everybody Ought To Know About How To Apply For Property Tax Adjustment

Provide proof that your spouse/civil union partner is deceased;

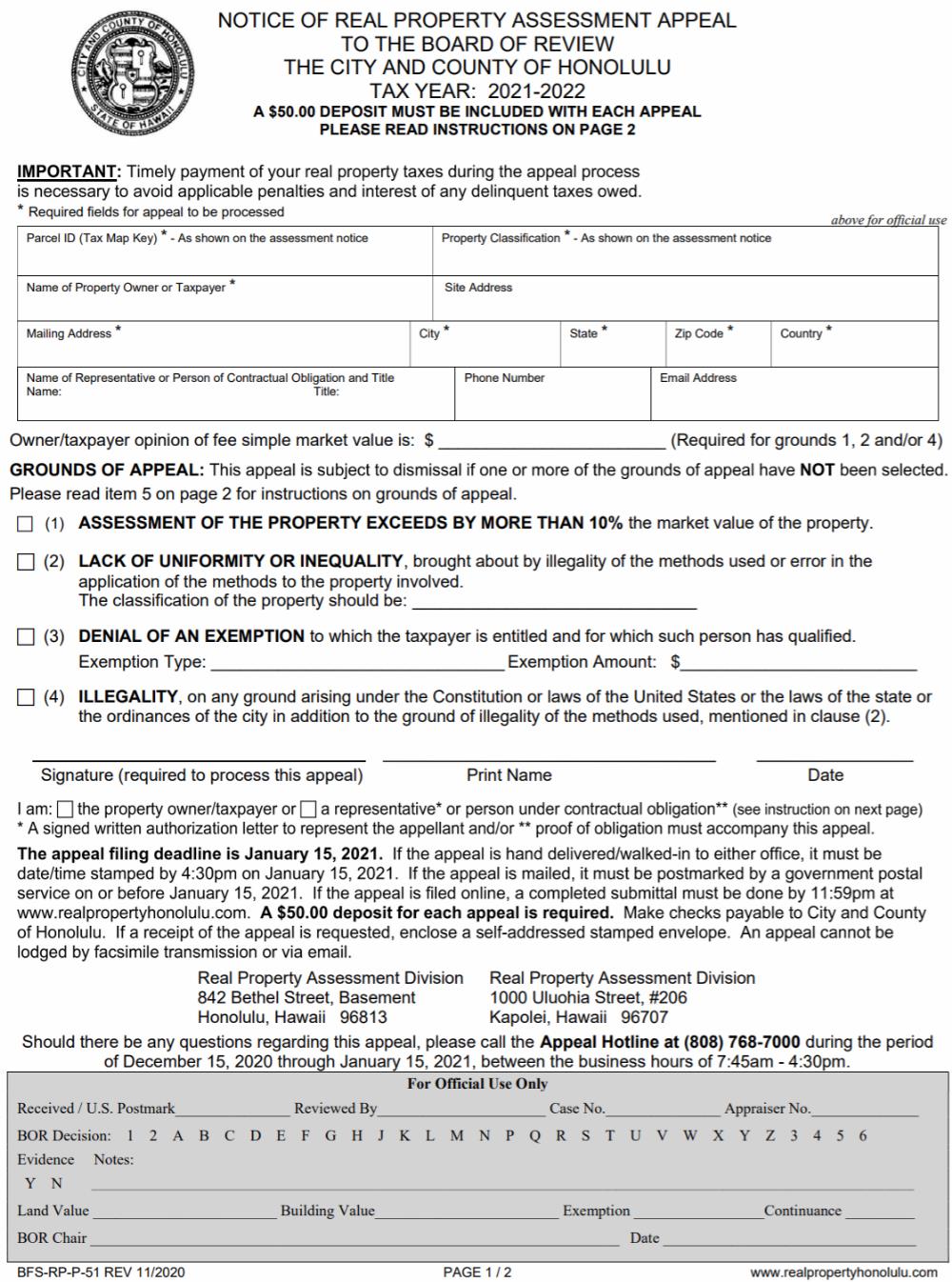

How to apply for property tax adjustment. 10%) = $10,000 (assessed value) note: Property tax adjust 2875 ne 191st street suite 703a aventura, florida 33180 phone: After subtracting the school operating tax from your property tax bill, you can claim 90% of the remaining property tax for the credit.

The property tax division takes no. The damage must have reduced the property’s value by. Please complete the form below to cancel, request a reduction or refund of property tax.

All applications made under the municipal act 2001,. When buying or selling a property, a portion of the annual property tax will be factored into the amount that you are paying or receiving, called the property tax adjustment. How to compute your homestead property tax credit, if.

To apply, download and complete the city of burlington's tax adjustment application form. Application for property tax adjustment. Assessed value x millage rate = unadjusted tax bill.

All property is to be assessed at full and true value. It’s calculated at 50 percent of your home’s appraised value, meaning you’re only paying half the usual taxes for your. The florida department of revenue's property tax oversight program provides commonly requested tax forms for downloading.

Find out if you qualify for a property. Determine the taxable value of the property. Taxing units are required by the state to offer certain mandatory exemptions and have the option to decide.

If you think you may qualify, please fill out an application to council for tax adjustment below. A total exemption excludes the entire property's appraised value from taxation. Property tax interest associated with a tax delinquent property held by the state and can be applied for by submitting an electronic application.

New york’s senior exemption is also pretty generous. Research land sales and submit an online. Submit your completed form to us by email at [email protected], by fax to 905.

Here’s how you calculate it: Then the property is equalized to 85% for property tax purposes. Most forms are provided in pdf and a fillable msword.

If the county is at 100% of. Your local tax collector's office sends you your property tax bill, which is based on this assessment. $100,000 (appraised value) x (residential rate: