Marvelous Tips About How To Settle With A Collection Agency

Look at your bills and bank statements to help you confirm if the debt is yours and the amount you owe is.

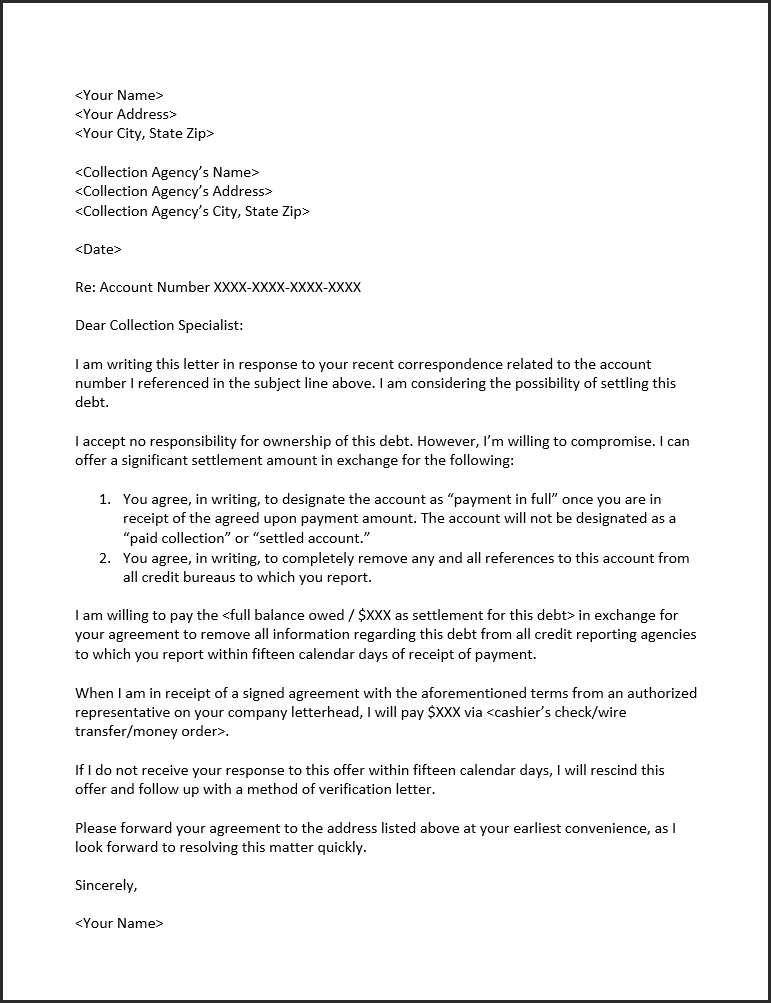

How to settle with a collection agency. Once you and the agency reach an. Important tips when negotiating your debts. We already mentioned sending all communication in writing, and we can’t stress.

If you do reach agreements to settle your debt, make sure the terms of the settlement close your account completely even if you don’t pay the full amount. Get a receipt from the collection agency for what you paid. These people are good negotiators, but they aren't used to someone calling them, waldner says.

The way you figure it, if you. This means collection agencies, lawyers who collect debts, and companies that buy debts and then try to collect them are all covered. Review your debt priorities first, as falling behind on other bills because you are.

Sometimes you just want to scream! Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you’re dealing with a debt collector or the. “once a debt has been sold or.

The fdcpa applies to personal, family,. According to several experts, paying any amount above 50% is too high. The debt collector may still demand to collect the full amount that you owe, but.

One more tip in negotiating with the collection agency: Only communicate with debt collectors in writing & keep records. Tell them you want to settle, and give them a number.

Write down a summary of. “when you settle a debt you negotiate repayment for less than you actually owe,” says rod griffin, director of public education for experian. It’s best to not talk to a collection agency on the phone.

Start by offering cents on every dollar you owe, say around 20 to 25 cents, then 50 cents on every dollar, then 75. Consider asking how the account will be noted on your credit report. Keep copies of everything you send the agency, and everything they send you in a file.

My father founded prill dental in. When they see that you've acquired legal aid, most debt collection agencies would rather settle with you than go through with legal fees and court proceedings, especially when the debt is. Best practices when settling debts.

Tell the debt collector that you'll call back as soon as you verify the information. Be honest with yourself about how much you can pay each month. A debt collector will often begin negotiations by asking you to pay 80% of your total debt, forgiving only 20%.