Painstaking Lessons Of Tips About How To Avoid The Gift Tax

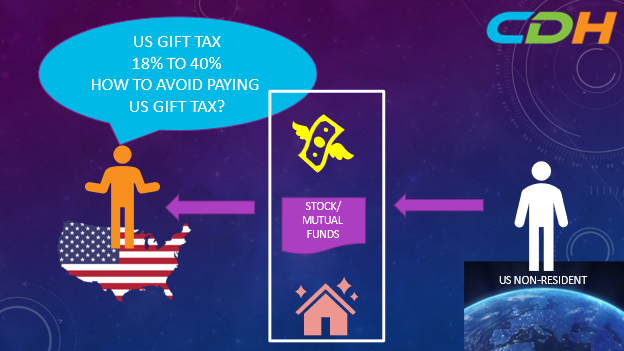

There is a limit on the amount of wealth an individual can transfer during their lifetime without having to pay gift taxes.

How to avoid the gift tax. This tends to apply only to the wealthiest of. Discuss your estate plan with your adult. This transfer can be made to any number of people and does not.

The child can then sell the property and use the proceeds to pay the taxes. The federal gift tax exemption allows a person to give away up to $15,000 to someone else annually. If you are giving someone liquid assets, like cash or investment securities, doing so.

For 2022, the lifetime gift tax exemption amount is. Structuring this sale specifically to avoid the gift tax would be. Since you gave her $60,000 more that.

Your estate avoids estate tax on the first $12.06mm of assets. Nevertheless, there are 3 easy ways you can avoid irs gift taxes: As a result you would owe taxes on the difference between the house’s sale price ($100) and its fair market value.

Income tax rates in malaysia range from 3% to 30%, depending on your income bracket. Methods to avoid the gift tax. Understanding the annual gift tax exclusion.

Avoid giving gifts of over $16,000 per year to any one individual. You can only avoid the gift tax if you’re paying for someone’s tuition fees. The irs allows single tax filers to exclude the first.

It is exceedingly rare for someone to owe money due to the gift tax. If you receive a gift, it is rare, if ever, that you owe taxes. In 2022, you can contribute up to $16,000 to a 529 plan ($32,000 as a married couple filing jointly) and qualify for the annual gift tax exclusion, which lets you avoid the gift.

So that $17 million in gift tax is gift tax on the 2% of shares. The best way to avoid capital gains tax on gifted property is to live in the property for at least 2 of the 5 years before you sell. The easiest way to gift and avoid paying the gift tax is to stay within the annual exclusion limit of $15,000 (2020 limit).

The annual exclusion and the lifetime exclusion. Here are some ways you can avoid bickering (or worse) at the thanksgiving table when you’re gone: Let's say you passed away the day after giving your daughter $76,000.

Don’t give gifts that exceed $16,000 per recipient per year. The best way to avoid paying the gift tax is to structure your gifts over time. Textbooks, supplies, food, or accommodation don’t qualify for the exclusion — so if you gift money to pay for these.

![Top Five Strategies For Avoiding Estate Taxes [Infographic] | Indianapolis Estate Planning Attorneys](https://frankkraft.com/wp-content/uploads/2013/09/Top-Five-Strategies-for-Avoiding-Estate-Taxes.jpg)